For tax years 2017 and 2018 the individual income tax rate is 5499. For 2018 most tax rates have been reduced.

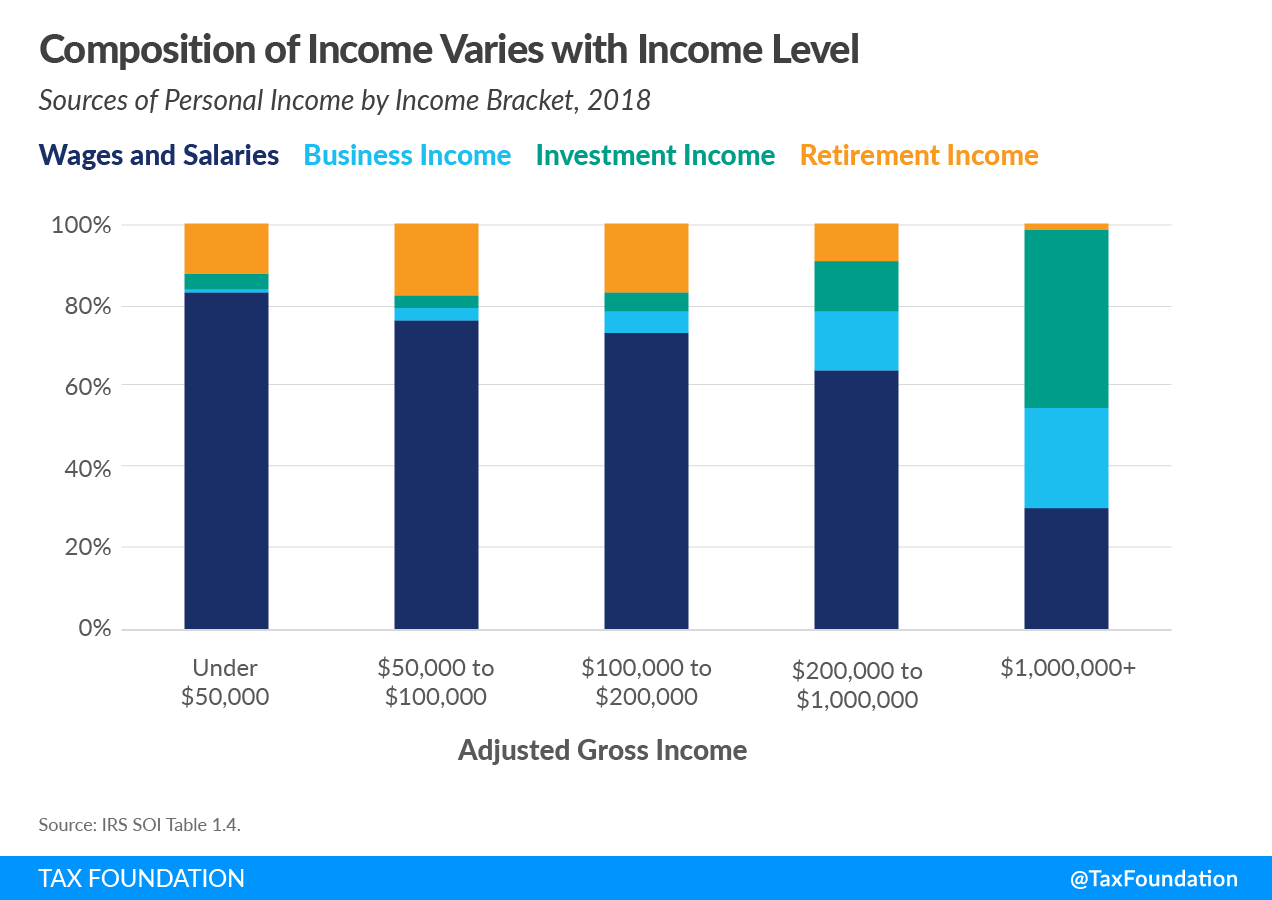

Sources Of Personal Income In The United States Tax Foundation

The personal income tax rates and personal allowances in the United Kingdom are updated annually with new tax tables published by HMRC.

. Change in tax rates. In 2018 the income limits for all tax brackets and all. Resident tax rates for 201819.

Instructions and Payment Voucher for Income Tax Returns. The federal individual income tax Collectively known as pass-through. Single or Married filing sepa-rately12000.

Ad Free Prep Print E-File Start Your Tax Filing Today. 51667 plus 45 cents for each 1 over 180000. A e r s ff hh Colo.

The above rates do not include the Medicare levy of 2. Federal tax brackets and rates for 2018. Changes to deductions impact taxable income.

File Your Individual Income Tax Return Online. 7 rows Income Tax Brackets and Rates. 205 on the next 50195 of taxable income on the portion of taxable income over 50197 up to 100392 plus.

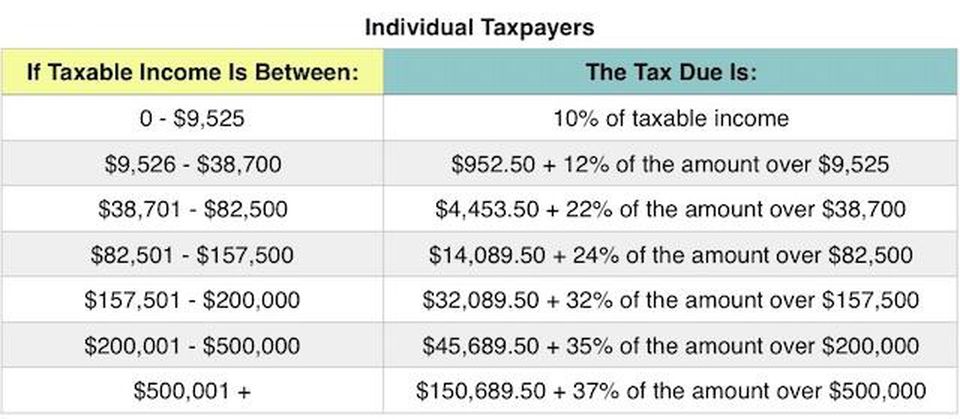

20797 plus 37c for each 1 over 90000. The 2018 tax rates are 10 12 22 24 32 35 and 37. Corporate tax revenues fell by 92 billion 31 due primarily to the Tax Act from 15 GDP in 2017 to 10 GDP in 2018 half the 50-year average of 20 GDP.

29467 plus 37 cents for each 1 over 120000. 0 Federal 1499 State. Tax on this income.

If you are looking for an alternative tax year please select one below. TurboTax Experts Can Help You File Today. 463 of federal taxable income 463 of federal taxable income.

Individual income tax receipts rose by 96 billion as the economy grew rising from 82 GDP in 2017 to 83 GDP in 2018. IT-201-X Fill-in IT-201-X-I Instructions Amended Resident Income Tax Return long form for 2018. Tax Rate for Tax Years 2017 and 2018.

Year 2018 Chargeable income Rate Tax payable Cumulative income Cumulative tax GHGH GH GH First 261 0 0 261 0 Next 70 5 350 331 350 Next 100 10 10 431 1350 Next 2810 1750 49175 3241 50525 Exceeding 3241 25 The chargeable income of non-resident individuals is generally taxed at a flat rate of 20. You are viewing the income tax rates thresholds and allowances for the 2018 Tax Year in South Africa. 3572 plus 325c for each 1 over 37000.

54097 plus 45c for each 1 over 180000. Dont Wait File Today. IT-203 Fill-in IT-203-I Instructions Nonresident and Part-Year Resident Income Tax Return.

For 2018 the standard deduction amount has been in-creased for all filers. Married filing jointly or Qualify-. Chris and Pat Smith are filing a.

Ad TurboTax Can Help You With All Your Previous Years Tax Questions. 19 cents for each 1 over 18200. The Tax tables below include the tax rates thresholds and allowances included in the United Kingdom Salary Calculator 2018 which is designed for salary calculation and comparison.

26 on the next 55233 of taxable income on the portion of taxable income over 100392 up to 155625 plus. See updated information available for this form. 15 on the first 50197 of taxable income plus.

Standard deduction amount in-creased. 19c for each 1 over 18200. Trusts other than.

Free Personal Federal Tax Returns. Discover Helpful Information And Resources On Taxes From AARP. For tax years beginning before January 1 2022 New York State personal income tax is decoupled from any changes made to the IRC after March 1 2020.

Foreign resident companies which earn income from a source in South Africa. Some LLCs Some corporations Partnerships Sole proprietorships Several significant changes to the individual income tax starting with 2018 tax year. The FTB keeps personal income tax returns for three and one-half years from the original due date.

Personal service provider companies. TAX FOUNDATION 4 State Individual Income Tax Rates and Brackets for 2018 Single Filer Married Filing Jointly Standard Deduction Personal Exemption State Rates Brackets Rates Brackets Single Couple Single Couple Dependent Alaska none none na. Therefore If you file an amended 2018 federal return due solely to changes made to the Internal Revenue Code IRC after March 1 2020 do not file an amended 2018 New York State tax return.

Ad Compare Your 2022 Tax Bracket vs. 5092 plus 325 cents for each 1 over 45000. How to Figure Tax Using the 2018 California Tax Rate Schedules.

Changes to tax rates impact tax due. To get a copy of your tax return write a letter or complete form FTB 3516 Request for Copy of Personal Income Tax or Fiduciary Return. Your 2021 Tax Bracket To See Whats Been Adjusted.

Questions On Your 2018 Taxes.

How The Tcja Tax Law Affects Your Personal Finances

How Does The Deduction For State And Local Taxes Work Tax Policy Center

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

How The Tcja Tax Law Affects Your Personal Finances

Income Tax Tables In The Philippines 2022 Pinoy Money Talk

How Do State And Local Individual Income Taxes Work Tax Policy Center

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Who Pays U S Income Tax And How Much Pew Research Center

New Changes For 2018 Everest Associates

Government Revenue Taxes Are The Price We Pay For Government

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

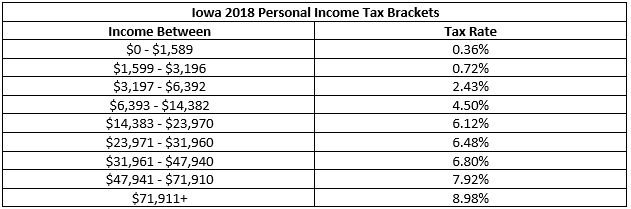

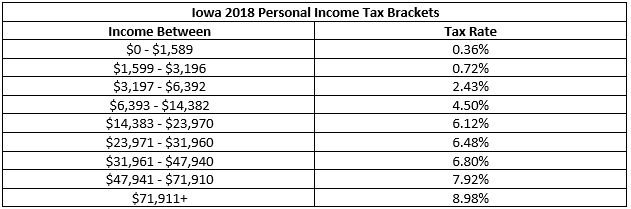

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

Tax Rates For Year Of Assessment 2018 T Plctaxconsultants

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

Sources Of Personal Income In The United States Tax Foundation

Government Revenue Taxes Are The Price We Pay For Government

State Corporate Income Tax Rates And Brackets Tax Foundation